Single Mom on Her Way to Financial Freedom

Lacy Ames • January 11, 2021

Single Mom on Her Way to Financial Freedom

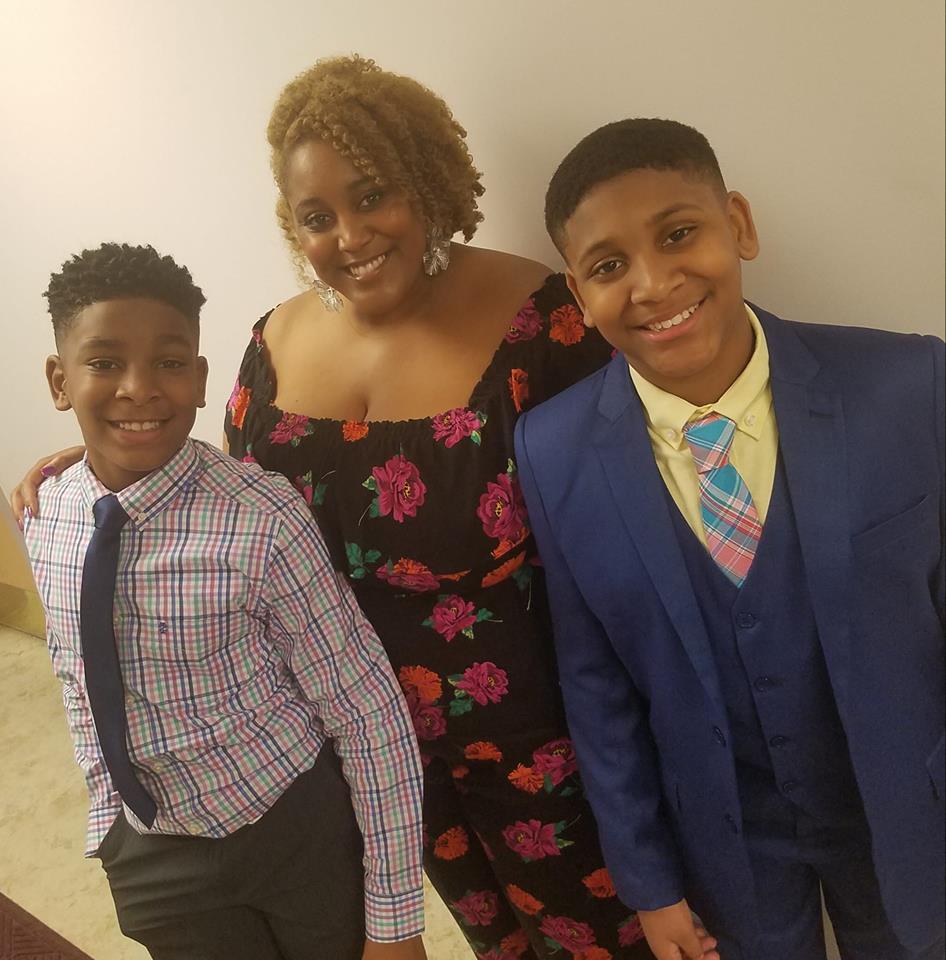

Kristina is a single mom to two teenage boys. She eventually found herself in a tough situation, where she had acquired a lot of debt over the years. She thought she would never be able to pay it all off.

Kristina had always had an interest in homeownership but like many others thought that she would never be able to realize such a dream on a single household income. She began to feel hopeful, though, when one of her single-mom friends told her about the success she’d had with Interfaith Housing Alliance’s (IHA) Purchase Repair Homeownership program - and that it all started with an IHA workshop called the Credit Cafe. That was all Kristina needed to hear.

Kristina now believes “everyone should attend the Credit Café so that they can learn how to manage their credit. Financial freedom is an amazing feeling, knowing you can get better rates, save money, and get out of the paycheck-to-paycheck cycle. So, everyone should go to the Credit Café to learn ways to pay off debt and increase those credit scores.”

Kristina knew her first step to homeownership was to pay off her debt, so she made the leap. In April 2018, she attended IHA’s Credit Café where she participated in a group workshop to learn general tips and tricks for improving and building her credit score. Afterwards, she met one-on-one with a credit advisor who guided her on how to apply the tips and tricks she learned in the workshop to increase her personal credit score and decrease her debt quickly.

Kristina’s journey to financial freedom did not come easy. It required even more sacrifice before she could begin reaping the benefits. She began picking up extra hours at her job, persevering through long work hours and saving up money to pay down her debts. She started introducing the Credit Café’s tips and tricks into her everyday spending habits and became a member of IHA’s first-ever monthly Single Moms group.

Just nine months later, Kristina returned to the Credit Café where her advisor delivered some great news: she was able to pay off $2,402 in outstanding debt and raise her credit score from 578 to 637. This amazing accomplishment in such a short period of time is a true inspiration to others out there with similar stories and experiences.

“I haven't purchased a home quite yet and I had to seek pre-approval through another lender. But this wouldn't have been made possible if it wasn't for me attending the Credit Cafés. I have become so knowledgeable on how to control my credit score and it keeps climbing.” IHA has no doubt that Kristina will achieve her dream of homeownership after all she has already accomplished with her finances. To register for a Credit Café, contact Lacy Ames at 301-788-0239 or lames@interfaithhousing.org.

Maryland and Frederick County: A Growing Housing Affordability Crisis Each year around this time, I share data that highlights the growing challenge of housing affordability in Maryland—and this year is no exception. Maryland now ranks as the 8th most expensive state in terms of wages needed to afford a modest two-bedroom apartment. A worker must earn $39.15 per hour —or nearly $81,450 annually —just to meet that threshold. Unfortunately, the situation in Frederick County is even more severe. Alongside Calvert and Charles counties, Frederick tops the list, requiring a staggering $44.50 per hour —equivalent to $92,560 annually —to afford a two-bedroom apartment. Meanwhile, the average renter in Frederick earns just $18.25 per hour , which translates to an affordable rent of only $949 per month —far below what the market demands. This stark disparity is exactly why the mission of Interfaith Housing Alliance (IHA) is so critical. We are committed to addressing these inequities and advocating for solutions that make safe, stable housing accessible to all. Below, you’ll find the 2025 data from the National Low Income Housing Coalition , detailing housing affordability across Maryland and its counties.

Interfaith Housing Alliance (IHA) is proud to announce two funding awards received this quarter from community partners. In July 2025, IHA received a $3,500 grant from The Croteau Family Charitable Gift Fund, which is a donor-advised fund (DAF) held at T. Rowe Price Charitable. IHA also received a $5,000 grant from The Natelli Communities Charitable Fund of The Community Foundation of Frederick County. These unrestricted funds will support all of IHA’s endeavors in strengthening the many communities we serve.

Money can sometimes feel overwhelming—but it doesn’t have to! This October, Interfaith Housing Alliance is offering our next Financial Freedom Bootcamp, a free, two-part workshop designed to help you take positive steps toward financial stability and confidence. The bootcamp kicks off with an in-person workshop on October 15th from 5:30–7:00pm, where participants will explore the building blocks of financial health. You’ll learn how to create a budget that actually works for your lifestyle, discover the best practices for saving, and walk away with strategies for reducing debt in realistic and manageable ways. After the first session, participants are invited to take part in an optional virtual Credit Café, a supportive space to dive deeper into questions about credit and money management. This extra resource helps reinforce what you’ve learned and gives you the chance to connect with others working toward similar goals. The second workshop will be held virtually on October 29th from 5:30–7:00pm, making it convenient to join from home. This session will focus on building confidence when communicating with creditors, understanding your credit, and setting SMART goals to stay on track for the future. Together, these two sessions provide practical, easy-to-use tools to support your financial journey. No matter where you are starting from—whether you’re new to budgeting, trying to rebuild your credit, or just looking for ways to feel more in control—Financial Freedom Bootcamp is a welcoming and encouraging place to begin. At a Glance What : Financial Freedom Bootcamp – free, two-part workshop series When: October 15th (in-person) & October 29th (virtual), both 5:30–7:00pm Topics: Budgeting, saving, debt reduction, credit confidence, SMART goal setting Extras: Optional virtual Credit Café between sessions Register: Contact Lacy Allen at lames@interfaithhousing.org or 301-662-4425 ext. 1203